At Bridges Holland, we provide a personal and friendly service to our clients.

Accounts | Accounting Software | Construction Industry Scheme | Payroll Services | VAT |

Tax Planning | Limited Companies

We work with clients of all sizes including sole traders, partnership and limited companies. We also have a large number of clients that have incomes from non business interests such as land and property incomes, income from investments and clients in employment.

Accounts

One of our primary services is to produce accounts for our clients as frequently as is required.

For our self employed clients, annual accounts are usually required to formally prepare Self Assessment Tax Returns which are in turn submitted to HM Revenue & Customs.

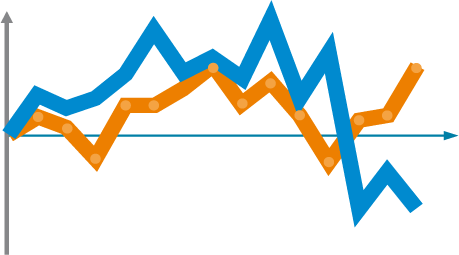

However it is often the case that interim accounts information is required so that day to day business decisions may be made. As such, we regularly prepare management accounts on a monthly and quarterly basis while comparing these results to historic results, budget forecasts and future cash flow predictions.

It may be that accounts and forecasts are required for presentation by the bank or other finance lenders. Bridges Holland can provide these documents which are tailored to the clients needs.

In respect of our limited company clients, we prepare annual statutory and abbreviated accounts and provide submission of these documents to the relevant bodies as appropriate.

Accounting Software

We can help you select the right solution for your business. Whether you are a start up or an existing business wishing to computerise your records our online system powered by Kashflow Accounts can be configured for you on a 60 trial. This allows you time to ask any questions you need to and we can log on and assist you as required. The ongoing cost of the system is only £99 plus v.a.t. per annum.

If your records are already computerised we can help you get the best from your existing system. We have many years of Sage Accounts experience and can offer help with day to day queries and year end routines.

Construction Industry Scheme

We can offer help with both manual and computerised C.I.S.

We run an in house bureau service with online authorisation of sub-contractors and online filing of monthly returns.

Payroll Services

We can help you with the operation of your payroll. If you use a manual system we offer a year end service to file your P35 online and produce P60 forms for your employees. If you have computerised your payroll we will assist you with processing queries.

We operate our own in house bureau service for clients who don't want to run their own payroll, clients can telephone, fax or email us the details and we will do the rest.

VAT

It is common for our clients to outsource their VAT return completion to us, regardless of industry or VAT scheme they may have in place and we are able to submit the relevant figures directly to HM Revenue & Customs on the clients behalf.

Where appropriate we will advise our clients of any VAT schemes that may be available to them and the benefits that could be achieved should these schemes be undertaken.

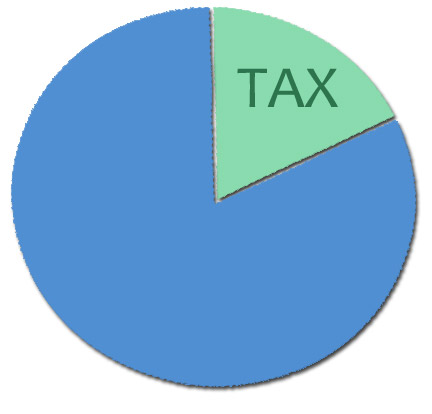

Tax Planning

Our team can help produce tax efficient strategies to minimise your personal tax, protect your personal assets and the profits of your business.

Limited Companies

With a range of experience in dealing with limited company clients, we are able to prepare full statutory annual and abbreviated accounts and provide submission of these documents to the relevant bodies as appropriate.

From a taxation point of view, the accounts preparation is followed up with the preparation of a corporation tax return, which is prepared in house. This is subsequently submitted to HM Revenue & Customs and Bridges Holland endeavour that all tax reliefs are utilised effectively to ensure the maximum benefit is passed onto our clients.